Understanding what happens to bank money after a person’s death is very important in India. Many families face confusion and even disputes because they do not clearly understand the difference between a nominee and a legal heir.

This guide explains the concept of nominee vs legal heir India, the legal position, and the practical bank process in simple and clear language.

Why This Topic Is Important

When a person passes away, their bank balance, fixed deposits, insurance policies, and other financial assets do not automatically disappear. They must be transferred legally.

However, confusion arises because many people assume that the nominee becomes the full owner of the money. This is not always legally correct.

Common Confusion Between Nominee and Legal Heir

- A nominee is appointed in bank records.

- A legal heir is determined by succession law.

These two roles are different.

Real-Life Situations Where Disputes Arise

- A father names one son as nominee, but has multiple children.

- A husband names his wife as nominee, but leaves no Will.

- A person forgets to update nomination after remarriage.

Such situations often lead to family disputes over bank money after death.

What is a Nominee in a Bank Account?

Definition of Nominee

A nominee is a person appointed by the account holder to receive the money from a bank account, fixed deposit, or financial instrument after the account holder’s death.

Nomination is allowed in:

- Savings bank accounts

- Fixed Deposits (FDs)

- Recurring Deposits

- PPF accounts

- Insurance policies

- EPF accounts

Purpose of Nomination

The main purpose of nomination is to make the transfer process smooth and quick. It helps banks release money without long legal delays.

Role of Nominee After Account Holder’s Death

After death:

- Bank verifies death certificate.

- Bank pays the balance to the nominee.

- Nominee receives the funds.

However, legally speaking, the nominee acts as a trustee.

Nominee as “Trustee” Concept

Under Indian law, a nominee is generally considered a trustee or custodian of the money — not necessarily the final owner.

Important clarification:

A nominee is not automatically the absolute owner of the money unless they are also the legal heir.

This distinction is central to understanding nominee rights in bank account cases.

Who is a Legal Heir?

Definition of Legal Heir

A legal heir is a person entitled to inherit the assets of a deceased person under applicable succession laws.

In India, succession depends on personal laws such as:

- Hindu Succession Act, 1956

- Muslim personal law

- Indian Succession Act (for Christians and others)

Class 1 Heirs (Under Hindu Law Example)

Under the Hindu Succession Act, Class 1 heirs include:

- Spouse

- Son

- Daughter

- Mother

These heirs have equal rights in the property if there is no Will.

Importance of Succession Laws

Legal heirs are determined by law, not by bank records. Even if someone is not a nominee, they may still have a legal right to the money.

This is why the issue of legal heir claim bank balance becomes important in disputes.

Nominee vs Legal Heir – Key Differences

Below is a simplified comparison:

| Basis | Nominee | Legal Heir |

|---|---|---|

| Defined By | Bank record | Succession law |

| Ownership Rights | Generally trustee | Actual legal owner |

| Role | Receives money from bank | Entitled to inherit assets |

| Final Claim | May need to distribute | Has legal inheritance right |

| Dispute Resolution | Court may intervene | Court decides as per law |

| Bank Process | Quick release | May require legal documents |

In simple terms:

The nominee helps in transfer.

The legal heir has ownership rights.

What Happens to Bank Money After Death?

Let us understand who gets money after death in different situations.

Case 1: If Nominee is Registered

Step-by-step:

- Legal heirs inform bank about death.

- Submit death certificate.

- Bank verifies nominee details.

- Bank releases money to nominee.

However:

- Nominee holds money on behalf of all legal heirs.

- If other legal heirs exist, they can legally claim their share.

- Courts have clarified in multiple judgments that nominee does not automatically become sole owner unless no other heirs exist.

This explains the real position of bank money after death rules.

Case 2: If No Nominee is Registered

The process becomes more complex.

Bank may require:

- Legal heir certificate

- Indemnity bond

- Succession certificate (in large claims or disputes)

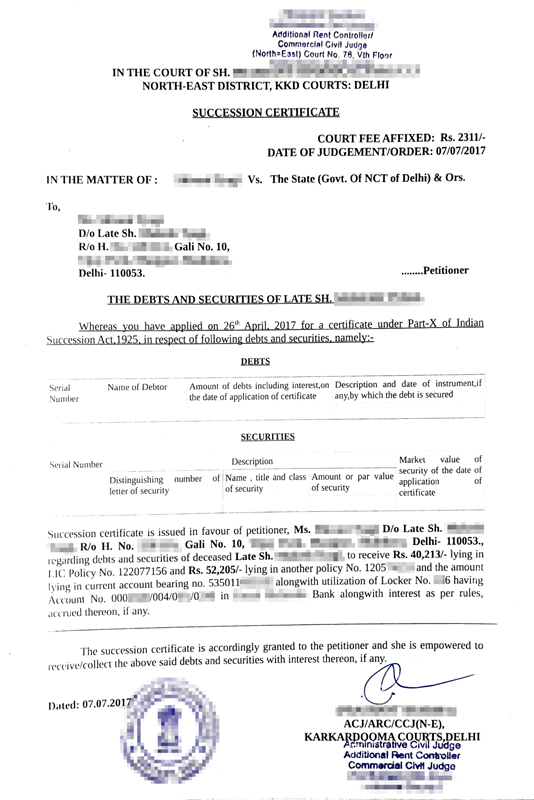

What is a Succession Certificate?

A succession certificate is issued by a civil court and legally authorizes heirs to collect debts and securities of the deceased.

Without nomination, the claim process can take months.

This is why banks strongly advise nomination in all accounts.

What Documents Are Required to Claim Bank Money?

Common documents include:

- Death certificate (original and copy)

- Claim form from bank

- ID proof of nominee or legal heir

- Address proof

- Nominee registration details

- Legal heir certificate (if no nominee)

- Succession certificate (if required)

Banks may also ask for indemnity bonds depending on amount.

What Happens in Joint Bank Accounts?

Joint accounts are different from nominee accounts.

Either or Survivor Rule

If account is “Either or Survivor”:

- Surviving account holder automatically gets control.

- Bank does not freeze account.

Joint Holder vs Nominee

Joint holder:

- Is co-owner during lifetime.

- Has operational rights.

Nominee:

- Has no rights during lifetime.

- Acts only after death.

Joint accounts usually avoid succession complications.

Special Cases

Fixed Deposits (FD)

If nominee exists:

- Bank releases FD maturity amount to nominee.

If no nominee:

- Legal heir documentation required.

Locker Accounts

Banks may allow nominee access to locker after due procedure. Legal heirs can still claim contents legally.

Insurance Policies

In many insurance cases:

- Nominee receives claim amount.

- But legal heirs may claim share unless nominee is beneficial nominee (as per Insurance Act amendments).

PPF and EPF

For PPF and EPF:

- Nomination is crucial.

- In absence of nominee, legal heirs must prove claim.

Understanding bank account succession rules India helps avoid delays.

Common Myths

Myth 1: “Nominee becomes full owner.”

Not always true. The nominee usually acts as trustee unless they are also legal heir.

Myth 2: “Will is not necessary if nominee exists.”

Incorrect. A registered Will can override nomination in many cases.

Myth 3: “Bank decides who the legal heir is.”

False. Banks only follow documentation. Courts decide legal heir disputes.

How to Avoid Family Disputes

To prevent legal complications:

- Always add nominee in all bank accounts.

- Update nomination after marriage or major life events.

- Write a clear and legally valid Will.

- Inform family members about financial accounts.

- Keep documents organized and accessible.

These steps reduce confusion in who gets money after death situations.

Official Nomination Rules – Bank Accounts (India)

| Regulation / Authority | Official Source |

|---|---|

|

Banking Companies (Nomination) Rules, 1985 – RBI Official rules governing nomination in bank deposits, lockers & safe custody | VIEW RBI RULES 1985 |

|

RBI Nomination Notification – Co-operative Banks Registration, cancellation & operational rules for nominee facility | OPEN RBI NOTIFICATION |

|

Banking Companies (Nomination) Rules, 2025 – Gazette Updated central government notification (multiple nominee provisions) | DOWNLOAD 2025 RULES (PDF) |

|

Indian Banks’ Association – Nomination Facility Guide Regulatory explanation of how nominee facility works in banks | READ IBA EXPLANATION |

Conclusion

The difference between nominee and legal heir is crucial in India.

- A nominee helps the bank release funds smoothly.

- A legal heir has ownership rights as per succession law.

Understanding nominee vs legal heir India prevents disputes and legal complications. While nomination makes the process easier, it does not automatically override inheritance laws.

Every individual should:

- Add nominees in all financial accounts.

- Keep nominations updated.

- Prepare a proper Will.

Taking these small steps today ensures financial clarity and family harmony in the future.