Before applying for a personal loan, home loan, or credit card, most people want to know whether they are eligible. Check Loan Eligibility Without Affecting Credit Score helps you understand:

- How much loan amount you may qualify for

- Whether your income is sufficient

- If your credit score meets lender requirements

However, many Indian borrowers hesitate to check eligibility because they fear their credit score may drop.

This fear usually comes from confusion about how credit inquiries work. Some inquiries can affect your score, while others do not. Understanding the difference between soft and hard inquiries is essential to protect your credit profile.

This guide explains how to check loan eligibility without affecting your credit score, using safe and legitimate methods.

What Is Loan Eligibility?

Loan eligibility refers to whether you qualify for a loan based on a lender’s criteria. Banks and NBFCs evaluate several factors before approving a loan.

1. Income-Based Assessment

Your monthly income plays a major role. Lenders check:

- Salary or business income

- Income stability

- Employment type (salaried or self-employed)

Higher and stable income generally improves eligibility.

2. Credit Score Requirement

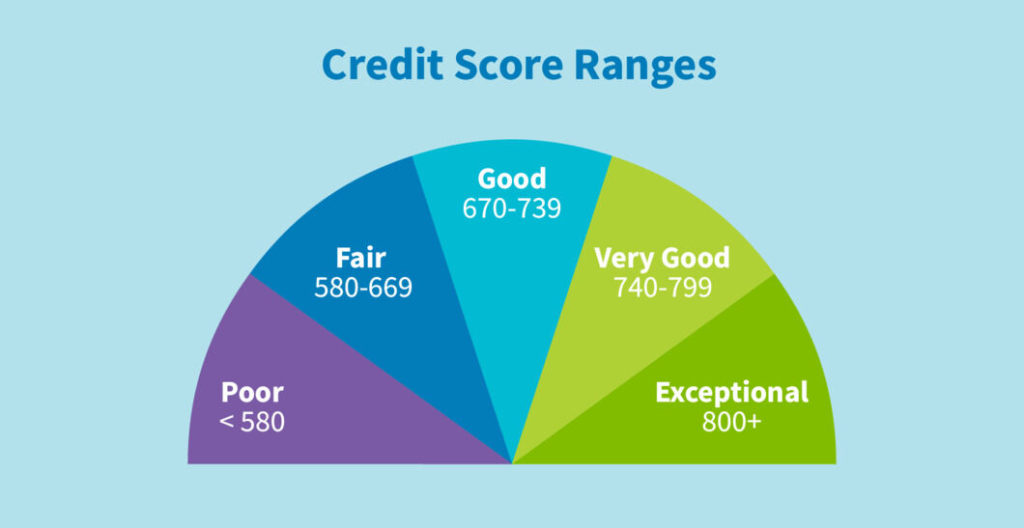

Lenders check your credit score from credit bureaus such as TransUnion CIBIL. A higher score indicates responsible repayment behavior.

Most lenders prefer a CIBIL score of 700 or above, though requirements may vary.

3. Existing Loan Obligations

Banks examine your current EMIs and outstanding loans.

If you already have multiple loans, your eligibility for a new loan may reduce.

4. EMI-to-Income Ratio

This is the percentage of your monthly income used to pay EMIs.

Many lenders prefer that total EMIs do not exceed 40% to 50% of your monthly income.

5. Bank’s Internal Policy

Each bank has its own internal risk policies and approval standards. Even if two people have similar income and credit scores, eligibility may differ based on lender policy.

Understanding these factors helps you estimate eligibility without applying formally.

Hard Inquiry vs Soft Inquiry – What’s the Difference?

To understand whether checking eligibility affects your credit score, you must know the difference between hard and soft inquiries.

Hard Inquiry

A hard inquiry occurs when you formally apply for a loan or credit card.

- The lender requests your detailed credit report from the bureau

- It is recorded in your credit history

- It is visible to other lenders

- It may slightly reduce your credit score

One or two hard inquiries are normal. However, too many hard inquiries within a short period can signal credit-hungry behavior and reduce your score further.

Soft Inquiry

A soft inquiry happens when:

- You check your own credit score

- You view pre-approved loan offers

- You use eligibility calculators

- A lender checks eligibility without a formal application

Soft inquiries:

- Do not affect your credit score

- Are visible only to you

- Are safe for preliminary checks

The key is to avoid unnecessary hard inquiries before you are sure about applying.

How to Check Loan Eligibility Without Affecting Credit Score

Here are safe and practical methods Indian borrowers can use.

Method 1: Use Bank’s Eligibility Calculator

Most banks provide online eligibility calculators.

Steps:

- Visit the official website of the bank.

- Open the personal loan or home loan section.

- Use the eligibility or EMI calculator.

- Enter basic details like income, existing EMIs, and loan tenure.

These tools provide an estimate without performing a hard credit check.

Always ensure you are using the official bank website, not third-party portals.

Method 2: Check Pre-Approved Offers

If you already have a savings account, salary account, or credit card:

- Log in directly to your bank’s secure online banking portal.

- Check the “Offers” or “Pre-approved loans” section.

Pre-approved offers are usually based on internal data and may involve only a soft inquiry.

This method is generally safe and does not affect your credit score unless you proceed with a formal application.

Method 3: Use Credit Bureau Soft Check Facility

You can check your credit score directly through official credit bureaus.

For example, you can access your report through TransUnion CIBIL.

Checking your own credit score is considered a soft inquiry and does not reduce your score.

Avoid suspicious third-party apps that promise “instant eligibility checks” and ask for excessive permissions.

Things to Avoid

To protect your credit score, avoid the following mistakes:

1. Applying to Multiple Banks at Once

Submitting applications to several lenders simultaneously can create multiple hard inquiries, reducing your credit score.

2. Clicking Unknown Loan Links

Fraudulent links may misuse your data or trigger unauthorized applications.

3. Sharing PAN and OTP Carelessly

Never share OTPs, PINs, or passwords. Even PAN details should be shared only on verified platforms.

4. Using Unverified Loan Apps

The Reserve Bank of India regulates banks and registered NBFCs. Always verify that the lender is authorized.

Does Checking Loan Eligibility Reduce CIBIL Score?

This is one of the most common concerns.

The answer is simple:

- A basic eligibility check does not reduce your CIBIL score.

- Checking your own credit report does not reduce your score.

- Viewing pre-approved offers usually does not reduce your score.

However:

- Submitting a formal loan application may create a hard inquiry.

- Multiple hard inquiries within a short period can reduce your score slightly.

Before proceeding, confirm with the lender whether the check is a soft inquiry or a hard inquiry.

Tips to Improve Loan Eligibility Safely

If you want to improve your chances without harming your credit score, follow these practical steps.

1. Maintain Good Repayment History

Always pay EMIs and credit card bills on time.

2. Keep Credit Utilization Low

Try to use less than 30% to 40% of your credit card limit.

3. Avoid Loan Defaults

Even one missed payment can negatively impact your credit report.

4. Maintain Stable Income

Frequent job changes or unstable income may reduce eligibility.

Improving these factors gradually strengthens your profile without needing repeated loan applications.

Frequently Asked Questions

How many hard inquiries are too many?

There is no fixed number, but several hard inquiries within 3 to 6 months may negatively impact your score. Apply only when necessary.

Is a pre-approved offer safe?

If it comes from your existing bank or a registered NBFC, it is generally safe. Always verify authenticity.

How often can I check my credit score?

You can check your own credit score multiple times without affecting it, as it is treated as a soft inquiry.

Can an eligibility check turn into automatic loan approval?

No. An eligibility check is only an estimate. Final approval depends on document verification and internal assessment.

Loan Eligibility, Credit Score & Digital Lending – Official Links (India)

Conclusion

Checking loan eligibility without affecting your credit score is completely possible if you use the right methods.

You can safely:

- Use official bank eligibility calculators

- View pre-approved offers through secure login

- Check your credit score directly from credit bureaus

Avoid multiple formal applications and unverified apps to protect your credit profile.

Understanding the difference between soft inquiry and hard inquiry helps you make informed financial decisions. Responsible borrowing, careful planning, and awareness of how credit systems work can help you maintain a healthy credit score while exploring loan options safely.